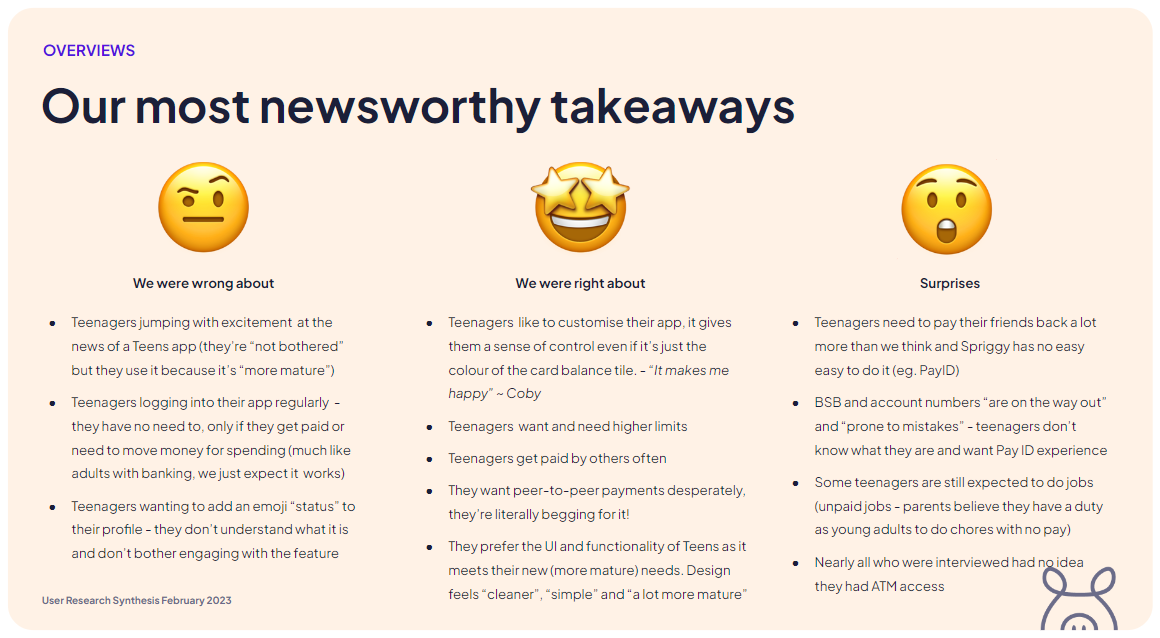

Having only been around for about a year, our Teens app product team found that they weren’t having as high as expected onboarding numbers shortly after releasing their new onboarding and KYC flows. So they asked me to conduct some research to find the cause and also get a general idea of what our Teens app families think of the app.

Teens weren’t interested in engaging with the app, for no reason other than they just use their card. They casually shout to mum/dad to check their balance or move money, because as teens are, they couldn’t be bothered getting off of TikTok to check their balance themselves, they seem to need to conserve their energy for who knows what… ha!

BSB and account numbers are “old fashioned”. The teenagers I interviewed mostly had no idea what it was, they just wanted something like PayID to pay their friends easily and instantly. In fact, they begged for it!

Teenagers want as much maturity as possible. The design of the Pocket Money app (from age 6-17)

The Teens product team then took my findings and went on to: