Spriggy’s key mission is to help families raise money-smart kids.

To date we’ve worked on creating an easy-to-use, kid-friendly mobile app with a solid focus on building features that help kids form these healthy habits, such as regular savings and completing chores as part of contributing to the household or earning extra money. But we felt we could do more on teaching kids when it mattered most.

Because we know 2 out of 3 adults in the world are financially illiterate (FinLit Survey 2014), how might we create an experience that helps children and their parents learn financial literacy skills early so that:

Once the Project Manager briefed me on the project, I worked autonomously to get this project from brief to build, only ever relying on the Project Manager and Developers to brainstorm where necessary.

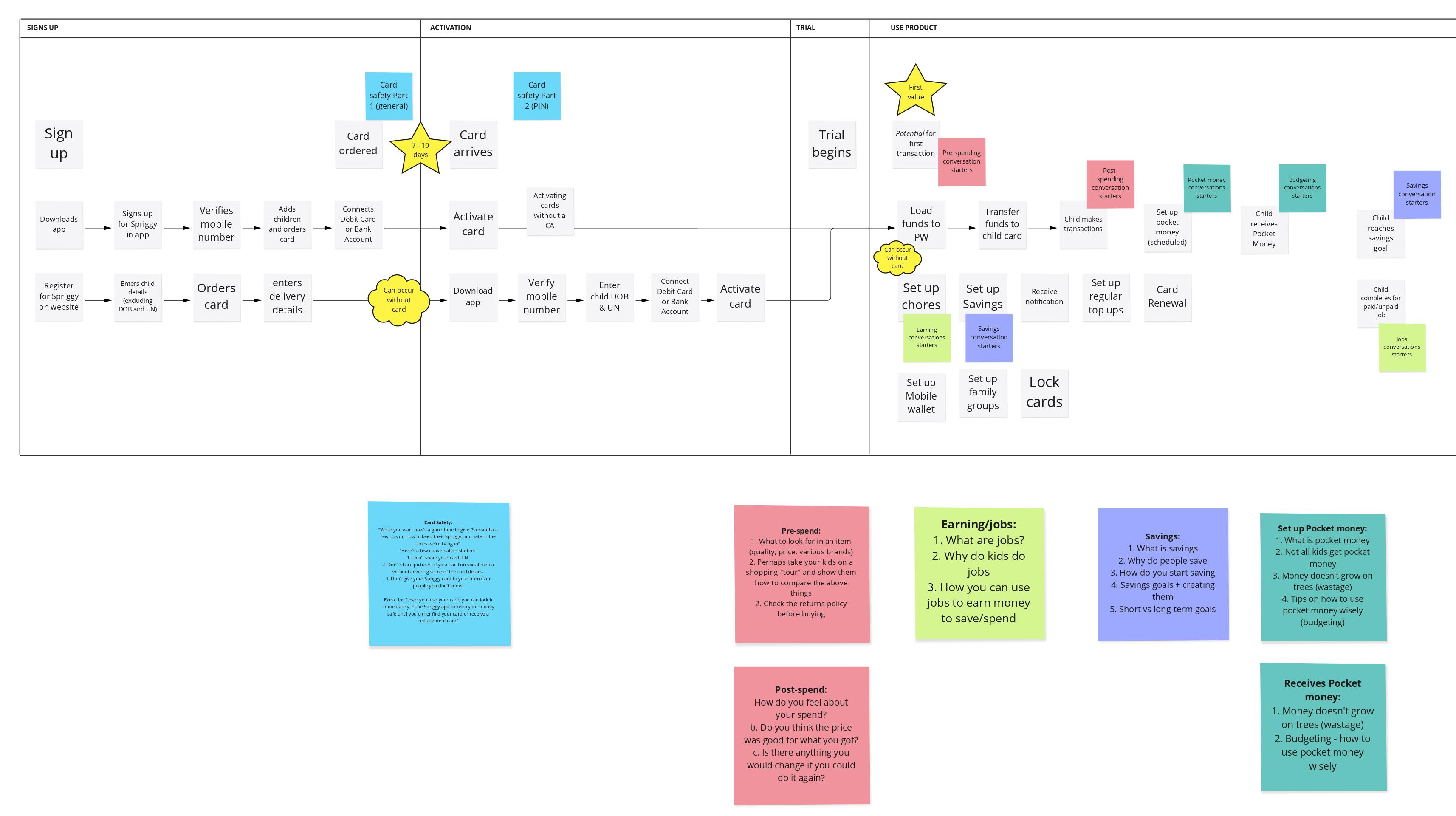

After narrowing down the statistics of when a kid starts to form money habits (7 years old) I drew up what a Spriggy kid’s typical spending journey looked like and what a kid’s typical spending journey looked like outside of Spriggy. This helped us identify the common moments most children experience when engaging with money, regardless of it being cash or digital money.

Other helpful insights were digging into this age group’s day-to-day life to get a deeper understanding of things that might affect the way they learn, such as the amount of spare time they and their parents have, any extra curricular activities, right down to basic psychological behaviours like concentration span for this age group, who influences them most, etc.

Lastly, as mentioned in the Problem statement above, 2 of 3 parents are not financially literate, with many of them feeling unequipped to talk about money with their kids. Does this impact a child’s relationship with money? Yes, it certainly does because parents either avoid having these conversations or they give the most basic advice that ultimately does not teach kids much, if anything, about how to manage money better.

Once I synthesised the research insights, I was able to:

Example scenario: Charlie makes his first purchase, mum is notified via a push notification on her phone. She can then decide to either chat to Charlie about his purchase in that moment, or after dinner when everyone is relaxed and open to a constructive conversation about Charlie’s purchase, eg. how he feels about his purchase, how he decided the item was a good purchase, what he thinks might be better in future, and so on.

Working within the Spriggy mindset, we thought big and built small with the idea to test it, learn from it and iterate our designs. So our MVP was deep-link push notifications to the parent when our system picked up a key teaching moment in the kid’s money journey (e.g. their first-ever spend/transaction). This notification deep links to a content screen in-app and the parent is able to consume helpful tips about this key learning moment and turn it into a constructive conversation with their kid if they choose to do so. These topics can be accessed at any time in the app from the home screen if parents want to take the reins on when to have conversations with their kids. We believe that kids learn best in the moment while fresh in their minds, resulting in them connecting the theoretical to the practical, which helps kids learn easier.

This new feature is currently being tested with 100 families and user interviews with the parents are being conducted to extract insights on how this feature has impacted the family conversations about money.

Main measurements of success:

Both these success measures are currently being measured through user interviews with parents and children who have used this Education feature for a few weeks to understand if there has been any change in the child’s money management behaviour.

What we hope to hear about in user interviews: